The world of trading is on the cusp of a dramatic evolution, with Depth of Market (DOM) trading emerging as a focal point of innovation. As we step into 2024, traders are not just spectators; they are navigating the tumultuous waters of an ever-changing landscape marked by technological advancements and shifting market dynamics.

From the integration of artificial intelligence to enhance trading strategies, to the growing importance of real-time data analytics, the tools at traders disposal are more sophisticated than ever. Yet, with these advancements come challenges, including the need for heightened regulatory scrutiny and increased competition among market participants.

This article delves into the trends and predictions shaping the future of DOM trading, exploring how these elements will redefine the trading experience and what traders can anticipate in the months to come. Buckle up; the future is not just near—its already here.

Introduction to Depth of Market Trading

Depth of Market (DOM) trading represents a dynamic and intricate facet of financial markets, where traders glean insights from the order book to navigate price movements with precision. In essence, DOM provides a real-time glimpse into the buy and sell orders that populate the market, revealing the layers of supply and demand that influence asset prices.

As we forge ahead into 2024, the landscape of DOM trading is evolving, shaped by technological advancements, algorithmic trading strategies, and the increasing prominence of retail investors. By using Depth of Market software, traders can efficiently analyze and act on market data, gaining a clearer view of order flows and liquidity at various price levels. This software enhances precision by offering customizable features such as real-time order tracking, automated execution tools, and visual analytics.

Traders can anticipate where large orders might trigger reversals or breakouts, providing opportunities to align their strategies with market momentum. As DOM trading tools become more advanced, their integration with algorithmic trading platforms further redefines how traders interact with the markets, leading to faster execution and improved decision-making.

In this evolving environment, mastering the use of DOM software becomes essential for both novice and experienced traders, equipping them with insights that traditional charts may overlook.

Cybersecurity Threats and Mitigation Strategies

In the evolving landscape of depth of market trading, cybersecurity threats loom ever larger, casting a shadow over the integrity of financial transactions and sensitive user data. As trading platforms become more interconnected and reliant on advanced technologies, they face a multitude of potential threats—from sophisticated phishing attacks to malicious software designed to exploit system vulnerabilities.

Traders must remain vigilant, deploying robust multi-factor authentication and encryption protocols to safeguard their information. Moreover, the implementation of real-time monitoring systems can serve as an early warning mechanism against anomalies that could indicate an impending breach.

In this dynamic environment, fostering a culture of cybersecurity awareness among all stakeholders—from traders to IT staff—is paramount, as human error often remains the weakest link in digital defenses. As we advance into 2024, a comprehensive approach to cybersecurity, combining cutting-edge technology and proactive education, will be essential in mitigating these risks and ensuring a secure trading experience.

Developing Robust Risk Management Strategies

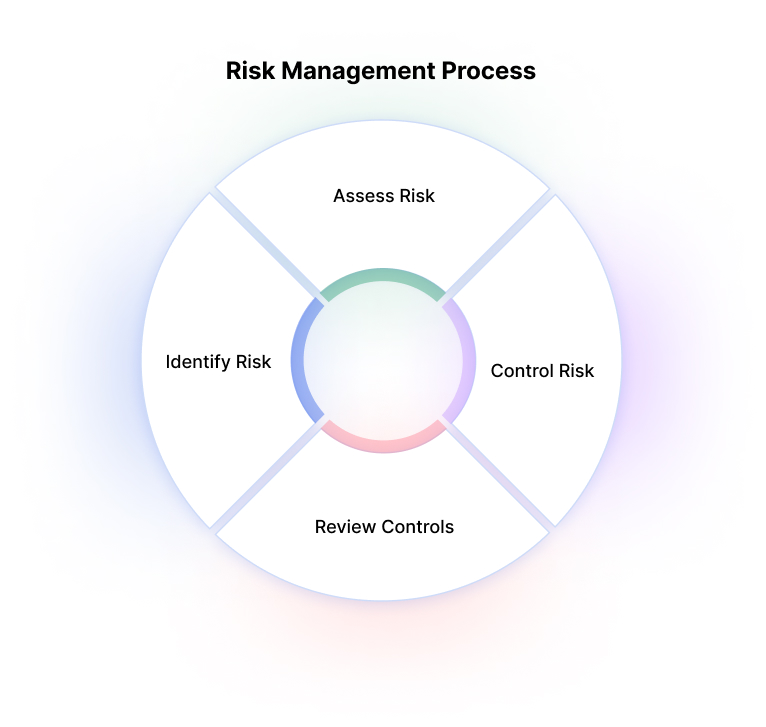

As the landscape of depth of market trading evolves, developing robust risk management strategies becomes increasingly critical. Traders must navigate an intricate web of market dynamics that can shift with startling speed, often leaving the unprepared at a disadvantage.

It’s no longer sufficient to rely solely on historical data; the integration of real-time analytics and predictive modeling emerges as essential. Utilizing advanced algorithms to forecast potential market movements allows traders to stay ahead of the curve, while tools like stress testing and scenario analysis equip them to respond dynamically when volatility strikes.

Furthermore, fostering a culture of continuous learning and adaptability within trading teams can enhance overall resilience. In this rapidly changing environment, the ability to anticipate risks and implement effective mitigation strategies is what will ultimately distinguish successful traders from the rest.

Conclusion

In conclusion, the future of Depth of Market trading looks promising as technological advancements and evolving market dynamics shape its landscape. As traders increasingly recognize the importance of real-time data and precise execution, the reliance on innovative solutions like depth of market software will be paramount.

The integration of artificial intelligence and machine learning, alongside enhanced regulatory frameworks, will further refine trading strategies and improve market efficiency. As we move into 2024 and beyond, staying ahead of these trends will be essential for traders seeking to navigate the complexities of the financial markets with confidence and agility.

Embracing these developments will not only empower traders but also pave the way for a more transparent and competitive trading environment.