In the fast-paced world of trading, where milliseconds can spell the difference between profit and loss, understanding market dynamics is crucial. Enter Depth of Market (DOM)—a powerful tool that reveals the intricacies of buy and sell orders in real-time.

Think of it as a window into the very heartbeat of the market, displaying not only prices, but the volume of orders lurking just beneath the surface. For savvy traders, mastering DOM can provide unparalleled insight, allowing them to anticipate market movements and capitalize on fleeting opportunities.

But how do you navigate this complex web of data? This article delves into the mechanics of Depth of Market, exploring its significance and offering key strategies for traders eager to harness its potential effectively. With the right knowledge, you can transform the overwhelming flux of information into a strategic advantage.

What Does Depth of Market Show?

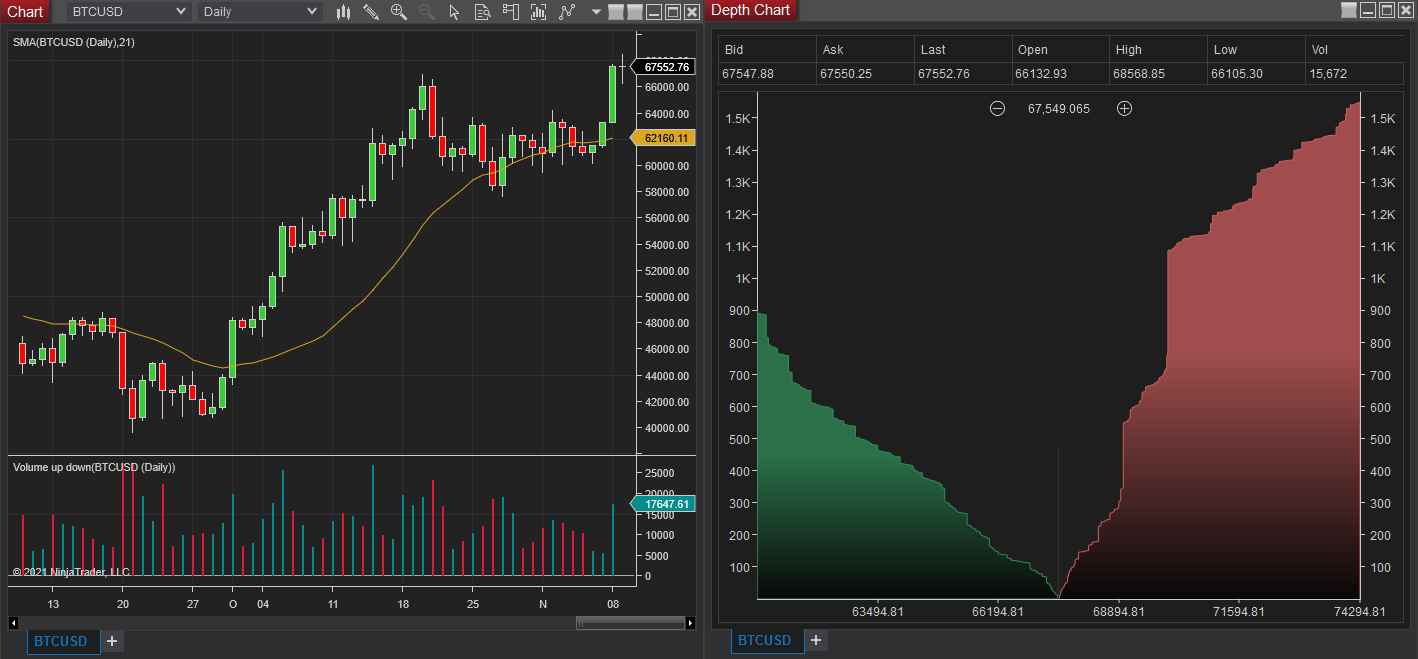

Depth of Market (DOM) provides a detailed snapshot of the supply and demand dynamics for a specific asset, laying bare the buy and sell orders at various price levels. More than just a numerical display, DOM reveals the markets immediate sentiment, showcasing where traders are willing to enter or exit positions.

For instance, a significant accumulation of buy orders at a certain price point might signal strong support, suggesting that the asset could bounce back if it approaches that threshold. Conversely, heavy sell orders may indicate resistance, forewarning traders of potential downturns.

This intricate dance of orders allows market participants to make informed decisions, enhancing their strategic engagement with the ever-fluctuating tides of trading. By observing the intricacies of DOM, traders gain insights that go beyond mere price movement, tapping into the psychology of their fellow market participants.

How Depth of Market Works

The Depth of Market (DOM) is a powerful tool that offers a detailed view of the supply and demand dynamics for a particular asset. At its core, DOM displays the quantity of buy and sell orders at various price levels, creating a layered perspective of market sentiment. Think of it as a bustling marketplace: vendors (sellers) and customers (buyers) are engaged in constant negotiation, each willing to trade at different prices.

Traders can gauge which price levels are heavily supported or resisted, allowing them to position their strategies effectively. For instance, a thick cluster of buy orders at a particular price may suggest strong support, while a surge in sell orders can indicate a potential overhead resistance.

This intricate tableau not only reveals potential entry and exit points but also enhances a trader’s ability to anticipate price movements based on the underlying market psychology, setting the stage for informed decision-making amidst the complexities of trading.

Benefits of Using Depth of Market

Using Depth of Market (DOM) offers traders a powerful window into market dynamics, providing insights that go beyond traditional price charts. By visualizing the buy and sell orders at different price levels, traders can gauge the strength of support and resistance areas, ultimately enhancing decision-making.

This depth of insight enables savvy traders to predict potential price movements with greater accuracy, capitalizing on market fluctuations more effectively. Furthermore, DOM allows for the identification of liquidity pools, helping traders to set optimal entry and exit points.

In essence, mastering DOM transforms trading into a more nuanced endeavor, equipping traders with the tools to navigate the markets ebb and flow with confidence.

Conclusion

In conclusion, understanding the depth of market (DOM) is crucial for traders looking to enhance their market analysis and decision-making processes. By effectively utilizing DOM, traders can gain insights into market liquidity, identify potential price movements, and make more informed trading decisions.

As the trading landscape continues to evolve, embracing tools like depth of market will empower traders to develop strategies that are not only responsive but also aligned with real-time market dynamics. Ultimately, mastering the depth of market can lead to a more proficient and confident trading experience.